INCONCRETO NEWS

Electric Vehicle Market in 2024: Growth Amidst Challenges

The electric vehicle market has made significant strides over the past decade, with 2023 marking a record year of growth. However, the performance in 2024, particularly in Europe, has been mixed, reflecting the complexity of transitioning to a fully electrified automotive market. Economic constraints, infrastructure inadequacies, supply chain issues, technological limitations, and consumer sentiment all play a role in this dynamic landscape.

The global EV market has witnessed exponential growth over the past few years. In 2023, electric car sales were 3.5 million higher than in 2022, a 35% year-on-year increase. This surge is more than six times the sales volume of 2018, illustrating the significant strides the industry has made. Remarkably, over 250,000 new EV registrations were recorded each week in 2023, surpassing the total annual registrations in 2013.

Battery electric vehicles (BEVs) have played a pivotal role in this growth, accounting for 70% of the electric car stock in 2023. This robust expansion underscores the maturity of the EV market and its increasing acceptance among consumers.

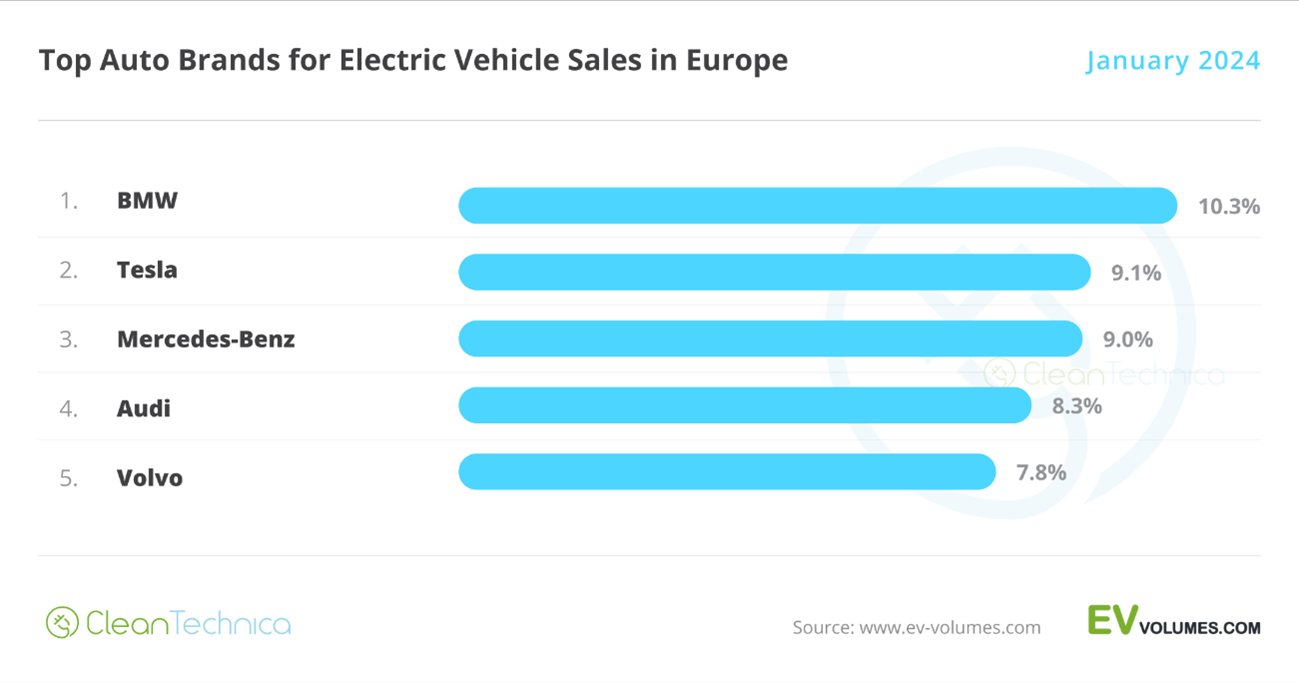

Despite the overall global growth, the European EV market has shown mixed performance in 2024. Sales in Europe grew by only 1% in the first half of 2024 compared to the same period in 2023, with 1.5 million EVs sold. This modest growth rate hides significant disparities across different countries. For instance, Germany experienced a 9% decline in sales, while France and the United Kingdom saw increases of 8% and 13%, respectively.

The month of May 2024 highlighted these trends, with 226,000 plug-in vehicles registered across Europe, marking a 10% decline compared to the previous year. This decline was more pronounced than the overall market’s 3% year-over-year decrease. These figures suggest that while the demand for EVs remains strong, several factors are tempering growth in certain markets.

Key Market Trends: Shifts and Challenges

One of the most notable trends in the European market is the decline of diesel vehicles. Registrations of diesel vehicles dropped by 11% year-on-year, holding only 12% of the market share. This decline indicates a significant shift away from diesel, well ahead of the 2035 internal combustion engine (ICE) ban.

Conversely, plugless hybrids have emerged as the fastest-growing technology, with a 15% year-on-year growth in May 2024, representing 30% of the total market. This trend highlights a gradual move towards electrification, though not exclusively through fully electric vehicles. As a result, hybrids remain a robust segment, providing a transitional solution for many consumers.

Affordability continues to be a major barrier to widespread EV adoption. Many EV models are priced at the higher end of the market, making them less accessible to a broader consumer base. Policymakers and industry stakeholders have called for adjusted incentives to favor lower-priced EVs, which could help counter the perception that EVs are only for the wealthy.

Additionally, recent price cuts have created uncertainty about the residual value of EVs. This hesitancy is particularly pronounced in markets where significant price fluctuations have occurred, making potential buyers wary of future depreciation. This uncertainty impacts consumer confidence and slows down the adoption rate.

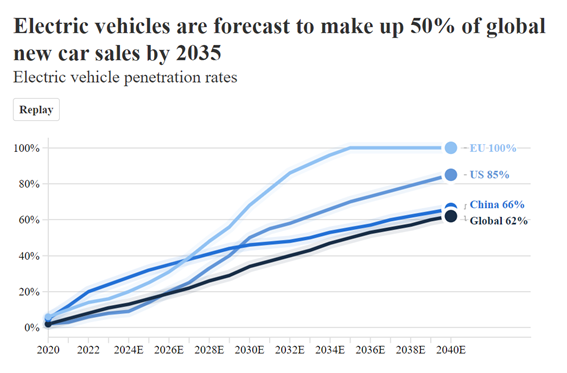

The global EV market is poised for significant growth, with projections indicating that EVs could make up nearly half of global car sales by 2035. Analysts forecast that more advanced autonomous or partially autonomous vehicles will also make up a similar share of sales by 2040. This fundamental shift is expected to upend labor markets, supply chains, and commodity markets.

Despite these optimistic forecasts, certain markets are experiencing slowdowns. For example, retail sales of electric passenger vehicles in India dropped by 13.51% year-on-year in June 2024. This decline is attributed to several factors, including economic constraints and supply chain disruptions.

While sales dropped in Europe, global sales of fully electric and plug-in hybrid vehicles rose by 13% in June versus the same month in 2023, driven by growth in China, market research firm Rho Motion said.

China accounted for over 60% of the total, as rising availability of electric vehicles and strong sales by BYD contributed to an increase in the domestic market share of PHEVs in the first half of the year.

Addressing the Challenges: Infrastructure and Technological Advancements

One of the critical barriers to EV adoption is the lack of comprehensive charging infrastructure. While urban areas are increasingly equipped with charging stations, rural and suburban regions still face significant gaps. The fear of being stranded without access to a charging point, often referred to as “range anxiety,” deters potential buyers. Furthermore, the pace of expanding and upgrading the grid to support the increased load from EVs has been slower than anticipated.

While EV technology has advanced significantly, it still faces limitations. Battery life, charging time, and the overall range of EVs have improved but not to the extent that satisfies all consumers. Many potential buyers are waiting for the next generation of batteries that promise faster charging and longer range before making the switch from conventional cars.

The future of the EV market depends on coordinated efforts from governments, industry stakeholders, and technology developers. Addressing the challenges comprehensively will pave the way for a more robust and sustainable EV market. Policymakers need to provide long-term, stable support to bolster consumer confidence and accelerate adoption rates.

Moreover, advancements in battery technology and increased domestic production are expected to enhance the market’s stability and growth potential. These developments will likely lead to more affordable EV options, thereby broadening the consumer base.

The future of EVs holds great promise, with projections indicating a significant increase in global market share by 2035.

Discover the expertise of INCONCRETO and its Partners as the market continues to evolve, addressing these multifaceted challenges will be crucial for sustained growth. By overcoming the current barriers and fostering a supportive ecosystem, the

transition to electric mobility can be achieved, ensuring a sustainable and environmentally friendly future for transportation.

With a focus on improving predictability and maximizing profitability, we specialize in guiding Capex and Opex project investments to achieve optimal outcomes in the EV market.

For further readings, you may consult these sources

- International Energy Agency. (2024). Global EV Outlook 2024.

- European Alternative Fuels Observatory. (2024). [Europe’s EV Market Update May 2024]https://alternative-fuels-observatory.ec.europa.eu/general-information/news/europes-ev-market-update-may-2024#:~:text=The%20European%20electric%20vehicle%20(EV,the%20same%20period%20last%20year).

- Goldman Sachs. (2024). The Future of Four Wheels is All Electric.

- Euronews. (2024). Car Sales in Europe Decline.

- Electrive. (2024). Mercedes Electric Sales Decline.

- Reuters. (2024). Global EV Sales Up 13% in June, Down 7% in Europe.

- Drivespark. (2024). India Electric Vehicle Sales Decline June 2024.

- Rho Motion says (2024). https://www.reuters.com/business/autos-transportation/global-ev-sales-up-13-june-down-7-europe-rho-motion-says-2024-07-11/.

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM