INCONCRETO NEWS

From Generics to Innovation: India’s Pharma Journey Aiming at Global Competitiveness

In recent years, India’s pharmaceutical industry has emerged as a global leader, driven by several key factors that have elevated its status both domestically and internationally.

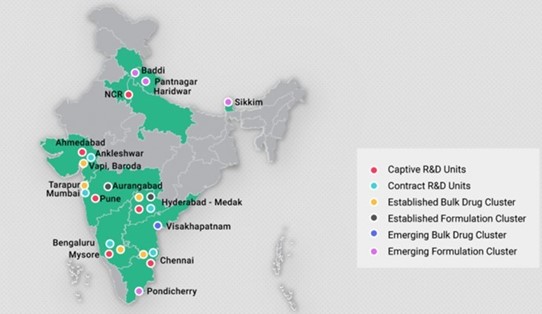

As highlighted in one of our recent LinkedIn publications, one of the main drivers of this success is the geographically diverse distribution of manufacturing hubs across the country, producing a wide range of pharmaceutical products.

With over 3,000 companies and 10,500 manufacturing units, the industry has become a cornerstone of the Indian economy, significantly contributing to GDP and attracting substantial foreign investment. Historically focused on generic drugs, over-the-counter medicines, vaccines, and active pharmaceutical ingredients (APIs), India meets a considerable portion of global demand, supplying 20% of the world’s generics and 60% of its vaccines.

For long-term global competitiveness, smaller Indian pharmaceutical enterprises will need better access to capital, as high borrowing costs remain a major hurdle. The average sales volume for Indian firms is approximately USD $45 million, compared to USD $258 million for U.S.-based pharmaceutical companies operating in India, highlighting the financial challenges domestic companies face in scaling up. Other critical obstacles include regulatory barriers, financial constraints, a shortage of skilled professionals, and difficulties in fostering collaboration within the industry. Overcoming these challenges is crucial for unlocking the sector’s full potential.

Looking ahead, India’s pharmaceutical sector is poised for impressive growth. However, to maintain and enhance its global standing, the industry must address critical challenges, particularly R&D investments and innovations in the digital supply chain. This article explores the vast opportunities for expansion and significant threats that could shape the industry’s future trajectory.

Bridging the gap in Pharmaceutical Research & Development

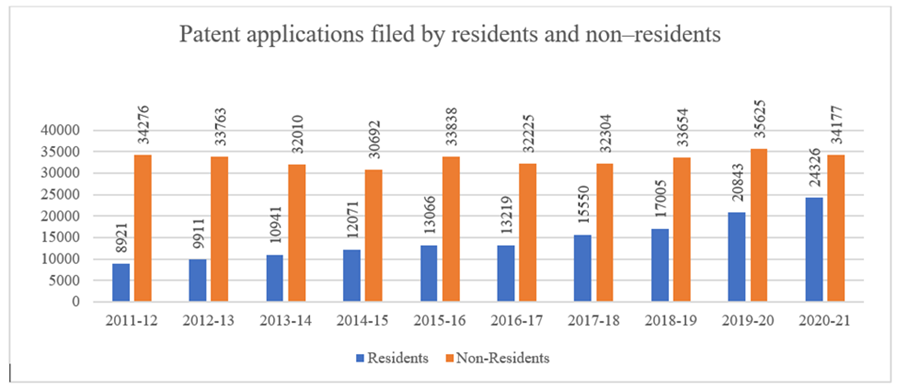

Prominent Indian economists recently have shown that the country’s rise in the pharmaceutical industry can be attributed to national investments in the 1980s and economic liberalization in the early 2000s. However, Indian pharmaceutical companies still lag behind global peers in Research and Development (R&D) investment, allocating just 1.5% of sales to R&D between 2000 and 2021, compared to 2.5% by foreign firms. This underinvestment hinders innovation and global competitiveness, with only 14% of Indian patents commercially active in 2020-21, compared to 37% in the U.S. and 30% in China.

A significant challenge lies in India’s reliance on public R&D funding, which accounts for 65% of total R&D investment, while private firms dominate in countries like the U.S. and China. Despite increased patent filings, foreign patents account for a large share of commercially successful innovations, reinforcing the need for greater private sector involvement to boost innovation.

Global pharmaceutical giants typically invest around 15% of sales in R&D, whereas Indian firms invest less than 2%. Without substantial private investment, India risks falling behind in the global innovation race. Closing this gap is essential to ensuring long-term growth and competitiveness in the pharmaceutical sector.

To address these challenges, Indian companies must increase R&D spending and attract more private sector engagement. Strategic incentives, such as increased R&D tax deductions, have already proven effective in boosting patent filings. The new National Policy on Research and Development and Innovation in Pharma-MedTech is another important step towards building a robust R&D ecosystem, positioning India as a global leader in pharmaceutical innovation.

R&D is not only essential for drug discovery but also for integrating cutting-edge technologies such as AI, automation, and big data analytics, which will be discussed later. Enhanced R&D capabilities will enable Indian firms to harness these technologies, drive efficiency, reduce costs, and solidify their position in the global pharmaceutical market.

Transforming India’s Pharma through Innovative Technologies

The Indian pharma supply chain is in the early stages of technology integration, a trend that accelerated in response to disruptions caused by the COVID-19 pandemic. Unpredictable demand patterns, manufacturing constraints, and infrastructure limitations led to increased costs for raw materials, transport and inventory management.

The Indian pharmaceutical sector is now on the brink of transformative trends, including digitization and the adoption of Pharma 4.0. With a target to expand the industry’s size to $130 billion by 2030, Indian pharma companies are diversifying their portfolios, developing capabilities for more differentiated and complex generics, investing in innovative firms, and building capacity for biosimilars.

An in-depth analysis by EY Parthenon and Bioasia 2024 highlights the industry’s shift towards personalized medicine and next-generation therapeutics, driving demand for just-in-time deliveries and innovative healthcare delivery models. Specific government initiatives, such as the Production-Linked Incentive (PLI) scheme and API Parks scheme, aim to bolster competitiveness in domestic manufacturing. However, rising costs present challenges to scaling up local production. Innovations offer potential for increased resilience, flexibility, and responsiveness in manufacturing and supply chain processes. To fully capitalize on these advancements, a parallel evolution in the supply chain is essential.

The adoption of end-to-end data traceability and big data analytics, through automation, artificial intelligence, blockchain solutions, and digital twins, enhances quality control while improving efficiency and transparency across the value chain, from manufacturing to supply chain operations.

Towards Efficient Manufacturing Processes

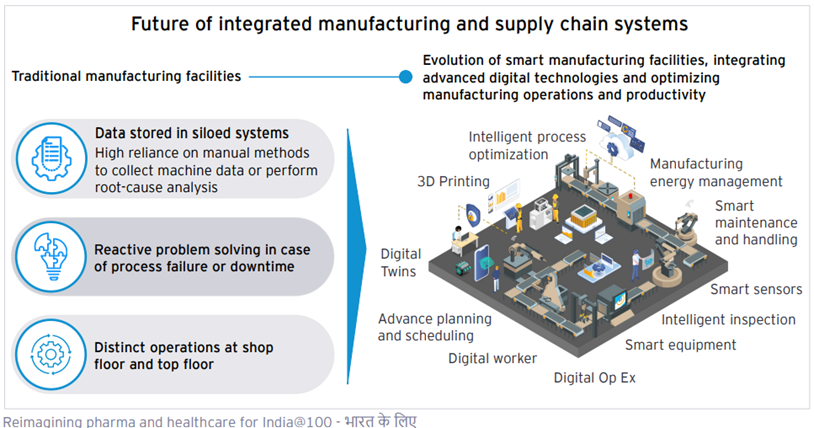

Indian pharmaceutical companies must modernize their manufacturing facilities by adopting digital technologies and undergoing transformations aligned with Industry 4.0. This transition is essential for ensuring compliance with Good Manufacturing Practices (GMP) and achieving better business outcomes.

Automation plays a crucial role in these advancements. Robotic systems provide fully automated inspection capabilities for high-value, small-batch treatments, reducing the need for human intervention. While robots currently focus on tasks like dispensing, sorting, and packaging, they are also addressing drug shortages caused by manufacturing delays.

To maximize the benefits of technology, companies must ensure that any selected solution is adaptable enough to fit within existing processes and quality standards. Several successful examples of automation integration exist. For instance, EY Parthenon and Bioasia 2024 report that a major manufacturer achieved a 30% reduction in production time by implementing robotic automation on its packaging line, leading to significant cost savings.

To succeed in the era of Pharma 4.0, companies must embrace automation and integrate emerging technologies such as AI, cloud computing, and big data analytics to enhance transparency, traceability, and accountability throughout the pharmaceutical value chain.

AI is revolutionizing pharmaceutical manufacturing by optimizing processes, supporting real-time quality control through IoT, and improving defect detection with deep learning models. Machine learning predicts equipment failures and suggests process enhancements, boosting both efficiency and quality.

Towards Resilient Supply Chains: From Reactive to Predictive Approaches

Growing global demand for resilient supply chains requires improvements in sourcing raw materials, distribution, and medication delivery. Digitization is essential for improving efficiencies, agility, and end-to-end visibility across the value chain. Leading pharmaceutical companies are using digital tools to strengthen supply chain risk monitoring, resulting in cost reductions and increased efficiency while addressing environmental, social, and governance (ESG) concerns.

Analysts from EY Parthenon and Bioasia 2024 note that Indian pharmaceutical companies have integrated various digital systems, such as electronic lab notebooks (eLNBs), electronic quality management systems (eQMS), and Enterprise Resource Planning (ERP) systems. By leveraging data analysis, these systems enable real-time optimization of logistics, enhance demad forecasting, and reduce supply chain costs.

These companies have the opportunity to adopt smarter, end-to-end integrated planning systems, enabling them to transition from reactive to predictive approaches. By investing in Big Data Analytics, AI, and Machine Learning, they can enhance decision-making, improve customer experiences, and gain a competitive edge.

As the industry accelerates its digital transformation, supply chain service providers are increasingly focusing on data-driven innovations to enhance pharmaceutical logistics, to enhance pharmaceutical logistics, optimizing fleet management, and addressing bottlenecks. A smarter inventory management approach aligns with manufacturing processes to ensure the right product quantities meet patient demands.

A smart inventory management approach aligns with manufacturing processes to ensure that the right product quantities meet patient demands. Leveraging predictive trace and tracking optimizes transport modes and minimizes distribution costs. Scenario analyses for over- and under-supply situations enhance resilience, while geography-based market trends and customer behaviours inform order forecasting. This comprehensive use of data enables timely deliveries and efficient stock management at distribution centres.

Sharmishtha Niyogi, Supply Chain Director at Merck, highlights the shift toward on-demand delivery models, emphasizing “direct-to-patient strategies and B2B e-commerce platforms, which ensured timely dispatch, order fulfillment accuracy, real-time monitoring of trading partners, and integration of the delivery network”, among other improvements.

Ms. Niyogi also points out that investments are being directed not only toward automating manufacturing but also other processes, such as packaging, to enhance productivity and operational efficiency. Consequently, the Indian pharmaceutical industry can strengthen its competitive advantage by localizing supply chains and increasing production through close-to-market manufacturing hubs.

While establishing the necessary digital infrastructure requires substantial investment, these technological advancements come with challenges, particularly regarding data privacy and cybersecurity. Addressing these issues is crucial for seamless visibility and supply chain efficiency.

By leveraging digital technologies, India’s pharmaceutical industry can transform traditional supply chains into patient-centric systems that secure its position as a global leader.

To secure its position as a global leader, India’s pharmaceutical industry must embrace digital transformation, enhance R&D, and invest in a robust, technology-driven supply chain. These changes are critical to ensuring that the industry not only meets current demands but also drives innovation in the future of global healthcare.

With a focus on improving predictability and maximizing profitability, INCONCRETO, as an international consultancy, can provide expertise in capital project optimization in the Indian Pharmaceutical Industry. Connect with our team!

For further readings, you may consult these sources:

- 7 Key Facts You Didn’t Know About the Indian Pharmaceutical Industry, by INCONCRETO

- India: the pharmacy of the world and its patent landscape, by iam-media

- From volume to value: Indian pharma’s transformation with data and AI, by EY Parthenon & Bioasia 2024

- The rise and rise of the pharmaceutical supply chain in India, by Maersk

- Changing Dynamics of Indian Pharma Supply Chain, by Pharmarack

- Digital Supply Chain: An Imperative for Success in the Pharma Industry, by Health – Economic Times

- Tech and policy evolution of India’s pharma supply chain, by ExpressPharma

To secure its position as a global leader, India’s pharmaceutical industry must embrace digital transformation, enhance R&D, and invest in a robust, technology-driven supply chain. These changes are critical to ensuring that the industry not only meets current demands but also drives innovation in the future of global healthcare

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM