INCONCRETO NEWS

From Hippocrates to Cell and Gene Therapy – Part II

Cell & Gene Therapy: the (recent) origins

Cell & Gene Therapy (CGT) has its roots in the second half of the 20th century. At this time, researchers started to discover the immense potential of incorporating DNA sequences into patients’ cells for treating people with genetic disorders.

However, it was necessary to wait until the beginning of the 1990s to launch the first gene therapy trial on humans. During this time, it was possible to better understand the immunogenicity and integration patterns of viral vectors. Technology was progressively improved, and delivery mechanisms were optimised: advancements included new chemistry, manufacturing, controls regulations and accuracy of oligo synthesis.

Ever since, the implementation of CGT has been growing, embracing other diseases beyond the genetic illnesses, and enabling the first wave of clinical success.

CGT was conceived with a specific focus on rare diseases, which remains paramount since patients have generally been underserved by other, more traditional, therapeutic modalities. Nevertheless, much of the early-stage CGT pipeline is in oncology. As of September 2019, roughly 25 % of the overall CGT in phases I and II of the pipeline is oncology focused. These oncology-directed therapies are competing with more traditional modalities and are called to prove their sustainability and increased cost-effectiveness.

Focusing on gene therapy itself, in 2018 alone more than 150 trials for new medicines applications were filed. The market of CGT is expected to meaningfully grow, with up to 20 CGT approvals per year over the next five years.

Traditionally, innovation and development in gene therapy have been led by small biotech companies or research universities, especially in London, Boston, and Shanghai – and secondly in San Francisco, Basel, and Cork. These start-ups have been seeking and finding partnerships with large pharma companies or specialized entities for CGT. In fact, 90% of CGT development is currently ensured by companies with fewer than 500 employees. Fostered by copious fundings, these biotechs have succeeded in deploying various clinical programs across diverse therapeutic areas.

The industrial model for CGT

The last trends show that, along with the increasing maturity of the technology behind the therapies, large groups in biopharma are shifting through a new paradigm. In fact, they are proving an unprecedented interest in owning the most cutting-edge technologies, instead of partnering. Two examples are telling: between 2018 and 2019, Novartis and Roche acquired respectively the start-ups Avexis (for $8.7 billion) and Spark (currently in negotiation for $4.3 billion).

More generally, companies that have recently acquired CGT assets have carried on different business models according to the circumstances. Some of them prefer not to integrate the CGT technological resource, with the aim to avoid potentially harmful continuous efforts to deploy it. Others, which tend to include the new asset, prefer to externalise specific commercial functions (such as patient engagement, site operations, and market access). In almost all cases, the model evolves over time, and lessons and results from CGT are increasingly incorporated into parent organizations.

Therefore, acquisitions are strategic for facing the most significant challenges in the sector. Such an approach allows for fostering research and development in CGT, which remains key for this branch of biopharma. In fact, since CGT is constantly embracing new fields of technology, knowledge on the subject is potentially enormous and the possibility of discovering something huge is tangible. Biopharmaceutical groups have invested several billion dollars in science, technological tools, and clinical trials – a necessary step before generating their first revenues.

In this sense, it becomes crucial to combine the effectiveness of the products with the coverage of the amplest number of patients. All that, of course, while ensuring that the ROI in manufacturing is sufficient enough and even more sustainable for the future.

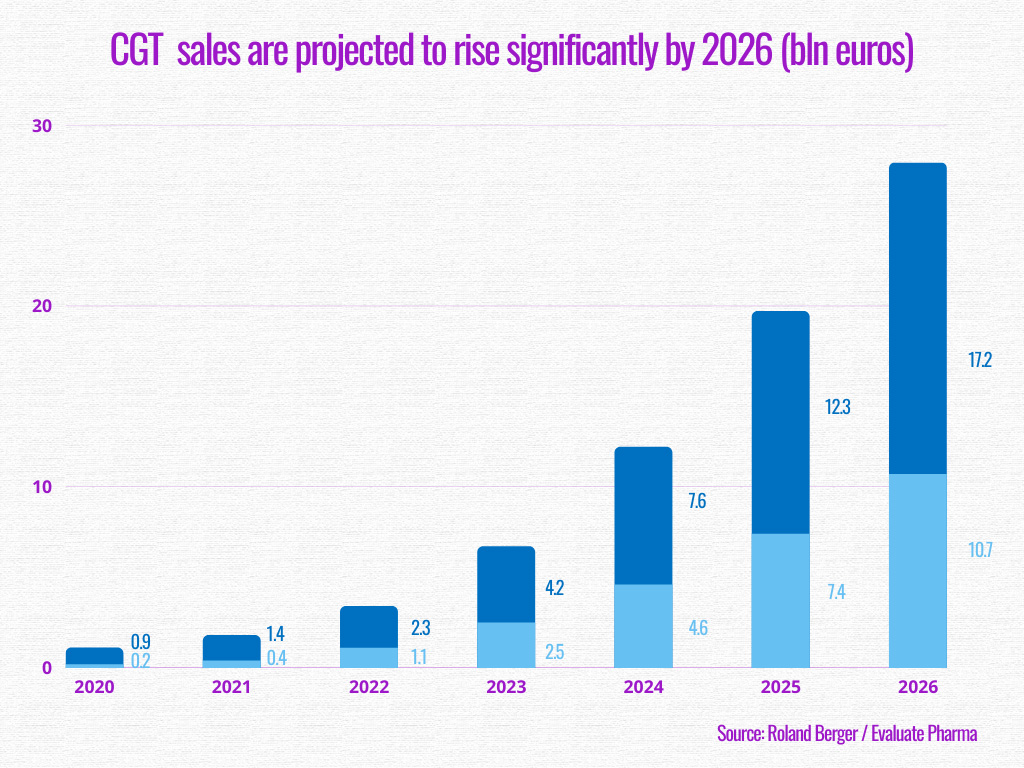

Since the beginning of the COVID-19 pandemic, efforts have been made through this ambition. According to an analysis conducted by Roland Berger, sales are expected to considerably rise, with gene therapy predicted to bring in 17.2 billion euros by 2026, and cell therapy 10.7 billion euros.

In order to fulfil these expectations, the biopharma industry is already implementing a new strategy. It is paramount to be prepared not only from a scientific point of view but also according to an optimised perspective in terms of organization and production.

Adapting to the characteristics of CGT implies an innovative and different supply chain, from the use of digital technology and data collection to manufacturing and delivery, making sure that these therapies become a complete success.

INCONCRETO, as an international consultancy, can provide expertise in capital project optimization and oversee critical paths for biopharmaceutical project execution.

Connect with our team! We combine technical expertise with large program execution practices, improving predictable outcomes and steering profitability on Capex/Opex project investments.

For further readings, you may consult these sources:

- Industry 4.0 for pharmaceutical manufacturing: Preparing for the smart factories of the future, by ScienceDirect

- Engineering Biology: The Evolution of the Biopharma Industry, by fiercebiotech.com

- Cell and Gene Therapies: Pharma’s Next Big Wave, by Roland Berger

- The Return of Gene Therapy, by Labiotech.eu

- Gene therapy coming of age: Opportunities and challenges to getting ahead, by McKinsey & Company

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM