INCONCRETO NEWS

Mining Today, Powering Tomorrow: The Global Race for Transition Minerals

As the world struggles to combat climate change, the transition to sustainable energy systems remains crucial. With the ongoing shift to cleaner energy solutions, the spotlight is turning more than ever to critical transition minerals which are essential for powering technologies driving the energy transition.

Transition minerals are naturally occurring materials, primarily found in rocks, that play a pivotal role in renewable energy technologies. Lithium, nickel, and cobalt are essential for manufacturing batteries, such as those used in electric vehicles. Rare earth elements are key components of the magnets used in wind turbines and electric motors. Meanwhile, copper and aluminium are critical for the extensive power transmission infrastructure needed to support clean energy systems. Most solar panels contain a combination of minerals such as aluminium, copper, silver, silicon, zinc, as well as some rare earth minerals like selenium and gallium.

The global extraction of key minerals for the energy transition is concentrated in a few countries and mostly exploited by a limited number of companies. It is paramount to observe that, while China is not the largest producer of these minerals, it remains the biggest importer, processing minerals for global distribution and refining processes. This central role has led to de-risking efforts by countries like the U.S. and EU to diversify supply sources and reduce dependence on China.

The Current Market of Minerals Worldwide

According to the Global Critical Minerals Outlook published by the International Energy Agency (IEA) this year, demand for transition minerals surged in 2023, driven by clean energy technologies. Lithium demand rose by 30%, while nickel, cobalt, graphite, and rare earths saw increases of 8–15%. Electric vehicles solidified their role as the largest consumers of lithium, with their share of demand for nickel, cobalt, and graphite also rising. In 2023, global EV sales reached 14 million, a 35% year-on-year increase, and are projected to continue growing as adoption expands in emerging markets. Meanwhile, solar PV and wind energy led global capacity additions, driving up the demand for copper and aluminium.

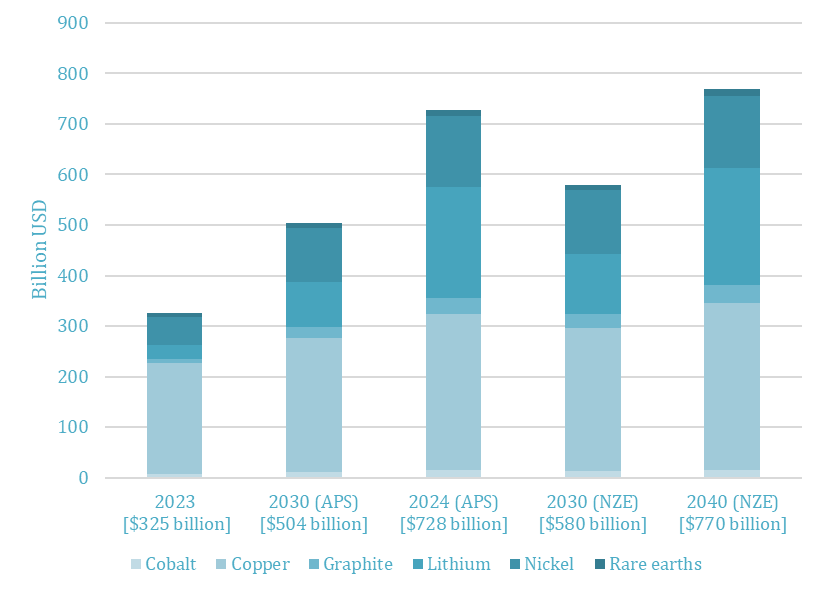

Demand for clean energy minerals is expected to double by 2030 in the IEA’s Stated Policies Scenario (STEPS) and triple in the Net Zero Emissions (NZE) Scenario. By 2040, the total demand for transition minerals could reach 40 million tons, with lithium seeing the most significant growth—expected to increase ninefold by 2040. Copper, essential for electrification, will see the largest rise in production, while graphite demand is projected to quadruple. Demand for nickel, cobalt, and rare earth elements is expected to double.

Despite significant price drops for battery materials in 2023 (with lithium down 75%, cobalt and nickel falling 30–45%), investment in critical mineral mining rose by 10%, with lithium-focused investments increasing by 60%. Exploration spending grew by 15%, particularly in Canada and Australia, and venture capital for battery recycling saw a 30% rise.

At present, supply constraints remain a concern. By 2035, announced mining projects may only meet 70% of copper and 50% of lithium demand. Nickel and cobalt markets face tight supply-demand balances unless new projects advance. Market concentration remains a challenge, with China dominating the refining of rare earths and battery-grade graphite. Meeting the NZE Scenario targets will require accelerated development of mining projects across key minerals.

The combined market value of energy transition minerals could exceed 770 billion USD by 2040 in the NZE Scenario, more than doubling today’s 325 billion USD.

Latin America is set to capture 120 billion USD of this, driven by copper and lithium, while Indonesia’s nickel production will double in market value. Africa is projected to see a 65% increase, though refining activities remain highly concentrated in China.

Market value of key energy transition minerals in the Announced Pledges Scenario (APS) and in the Net Zero Emissions Scenario (NZE), 2023-2040

Mapping the Most Important Minerals and Mining Sites in the World

Copper is a crucial material for the transition to clean energy, as it is indispensable in key technologies such as electric vehicles, solar photovoltaic panels, wind turbines, and electricity grids. Its unique properties, including excellent electrical conductivity, resistance to corrosion, and ductility, make it essential for these applications. This reliance on copper highlights the need for sustainable mining practices and the diversification of supply sources to meet increasing demand and reduce vulnerabilities associated with concentrated production in a few regions.

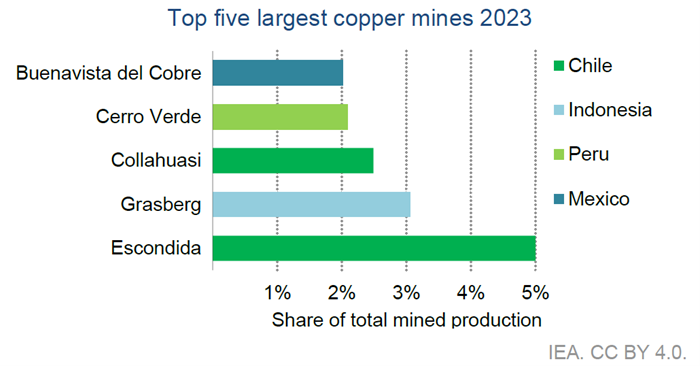

Chile remains the largest producer, but its share has decreased from 30% in 2015 to 25% in 2023 due to declining ore grades and ageing assets. Meanwhile, the Democratic Republic of Congo (DRC) has rapidly increased its share from 6% to 12%, becoming the second-largest supplier, thanks to high-grade copper resources like the Kamoa-Kakula mine. China, Russia, and Indonesia also contribute to global supply, with Indonesia doubling its share since 2020. In 2023, the top three copper mines accounted for over 10% of the global production.

Among transition minerals, lithium plays a pivotal role in powering the energy sustainability, being the ideal material for high-energy-density batteries.

Australia is the leading producer of hard rock lithium, primarily in the form of spodumene concentrate, producing 84 kt of lithium annually. Its mining sites are concentrated in the Western part of the country and notably include the brownfield mine Greenbushes Lithium Operations, which produced 0.21 mtpa of lithium in 2023, owned and operated by Talison Lithium, a joint venture between the Tianqi Lithium Energy Australia and the American Albemarle Corporation, the world’s largest lithium producer, with a market cap of about 12 billion USD. Other key sites comprise the brownfield Wodgina Lithium Mine, owned by Albermarle, the greenfield Mount Marion Lithium Project, owned by Ganfeng Lithium Group, and the brownfield Pilgangoora Project, owned by the Australian Pilbara Minerals, which also exploits the greenfield Ngungaju Plant Project. Most of this output is directly exported from Australia to China, where it undergoes refining.

Lithium derived from brine sources is extracted mainly from salt lakes in Latin America and the high plateaux of western China. In 2023, Chile produced 46 kt of lithium from brines, mostly in the Salar de Atacama Mine, owned by Sociedad Quimica y Minera de Chile, which is the second-largest lithium producer in the world, with a market cap of 11.43 billion USD. It is important to observe that China’s Tianqi Lithium owns about a fifth of the company, while another part of the Salar de Atacama Mine is composed of a greenfield project entirely exploited by Albemarle. Located in Argentina, the Salar del Hombre Muerto Mine is owned by Arcadium Lithium PLC, the third-largest lithium producer, formed in January 2024 from the merger of the American Livent, and the Australian Allkem. In China some prominent lithium mines encompass such as the Chaerhan Lake Mine, owned by Qinghai Salt Lake Industry, and the Jiajika Project, fully owned by Tianqi Lithium.

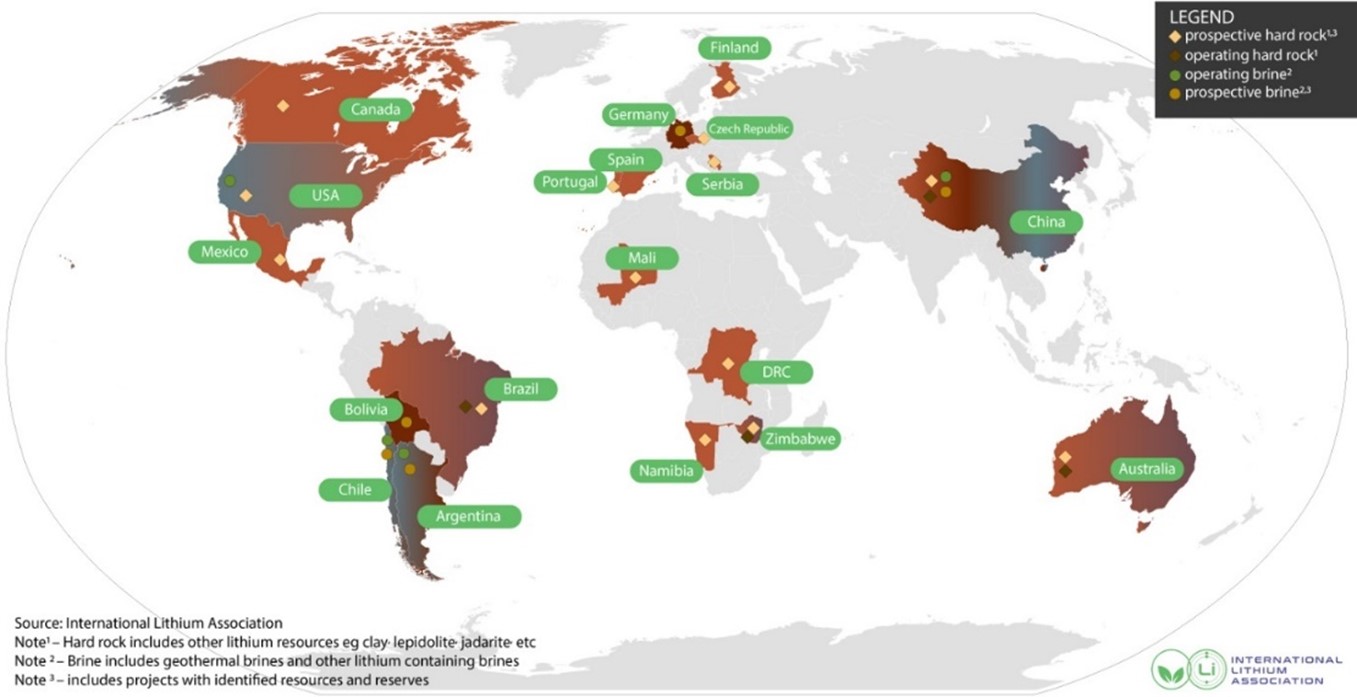

Lithium resources map

Nickel is a versatile metal, essential in both traditional and clean energy sectors. Nickel ores, classified into two main types – laterite and sulphide –, are crucial for EV batteries and play a significant role in renewable energy systems like wind turbines and geothermal power generation.

Indonesia plays a dominant role in global nickel production, driven by its vast reserves and significant investments in mining and processing infrastructure. The country not only leads in the output of laterite ores but has also developed high-capacity hydrometallurgy projects, such as PT Halmahera Persada Lygend and Vale Indonesia’s Sorowako Mine, which are among the world’s most prominent operations. The Philippines follows closely, with major players like Nickel Asia managing large-scale projects such as the Taganito and Rio Tuba Mines. Russia contributes significantly through Nornickel, while Colombia and Madagascar host key mines operated by the Australian South32 and the Japanese Sumitomo, respectively. Australia and Canada also remain critical to the supply of sulphide and laterite nickel, underscoring the global spread of this vital resource.

Widely used in lithium-ion batteries for electric vehicles and electronics, cobalt is a vital resource for the global energy transition. Found alongside copper and nickel deposits, its extraction occurs through underground and open-pit mining. The DRC leads global production, accounting for around 70% of supply, with major operators like the British-Swiss Glencore and the Chinese-owned CMOC Group running expansive operations such as the Katanga and Tenke Fungurume mines.

Other key players include Vale in Brazil, Rio Tinto in the US, and BHP in Australia, which produce cobalt as a by-product of nickel or copper mining. Indonesia has become a major cobalt producer, thanks to Chinese-backed investments in high-pressure acid leach (HPAL) processing facilities. Companies like PT Halmahera Persada Lygend and PT Huayue Nickel Cobalt control Indonesia’s four HPAL plants, which extract cobalt and nickel from low-grade laterite ores for the global battery market.

Innovating for a Sustainable Future: Technologies Transforming the Mining Sector

Technological advancements are crucial for addressing the mining sector’s sustainability and efficiency challenges. As noted by the World Economic Forum, growing environmental concerns and the depletion of traditional resources require innovative solutions to improve extraction processes and minimize environmental impacts. Technologies such as AI for streamlining exploration, blockchain for enhancing supply chain traceability, and advanced recycling methods are central to balancing supply, demand, and sustainability. Additionally, practices like closed-loop water recycling and the use of alternatives such as sodium-ion batteries help reduce reliance on scarce minerals. Businesses that adopt these innovative, responsible strategies can lead the energy transition and unlock substantial economic opportunities.

To address these challenges, companies in the mining sector are embracing various financing strategies, such as mergers, acquisitions, and partnerships, to manage large-scale projects and drive growth. A recent survey by EY highlights how sustainability remains a key focus, with increased efforts to reduce environmental impacts through innovations in waste management, water recycling, and collaboration with Indigenous communities for improved land stewardship. Geopolitical factors, including resource nationalism, are shaping tax policies and ownership rights, requiring mining companies to adjust their strategies. Additionally, the depletion of resources is driving the need for advanced exploration technologies and efficiency improvements to meet the rising demand while minimizing environmental impact.

Innovation and collaboration across the mining sector are the key drivers in achieving meaningful progress in the future.

With a focus on improving predictability and maximizing profitability, INCONCRETO is an international consultancy, leveraging the high-level expertise of its partners, that is specialized in capital project optimization in the mining sector.

Our services include:

– Business Planning and Project Execution Planning to optimize resource use and operational efficiency

– M&A Support, Due Diligence, and Auditing to assess and navigate mining investments

– Technology and Supply Chain improvements for the global mineral supply chain

For further readings, you may consult these sources

- What are energy transition minerals and how can they unlock the clean energy age?, by UNEP

- Global Critical Minerals Outlook 2024, by WEF

- Why China’s critical mineral strategy goes beyond geopolitics, by WEF

- Overview of the Lithium Industry in 2024, by INCONCRETO

- The Database of Mining Digital

- Which countries have the critical minerals needed for the energy transition?, by Our World In Data

- Investing in innovation will secure vital critical minerals for the energy transition – here’s where to start, by WEF

- Top 10 risks and opportunities for mining and metals companies in 2025, by EY

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM