INCONCRETO NEWS

Overview of the Lithium Industry in 2024: Global Insights and Industry Examples

In 2024, lithium continues to be a cornerstone of the global transition toward clean energy, with its pivotal role in rechargeable batteries for electric vehicles (EVs), renewable energy storage, and consumer electronics. The surge in demand for lithium-ion batteries is experiencing significant developments across the industry, impacting production, supply chains, and geopolitics worldwide.

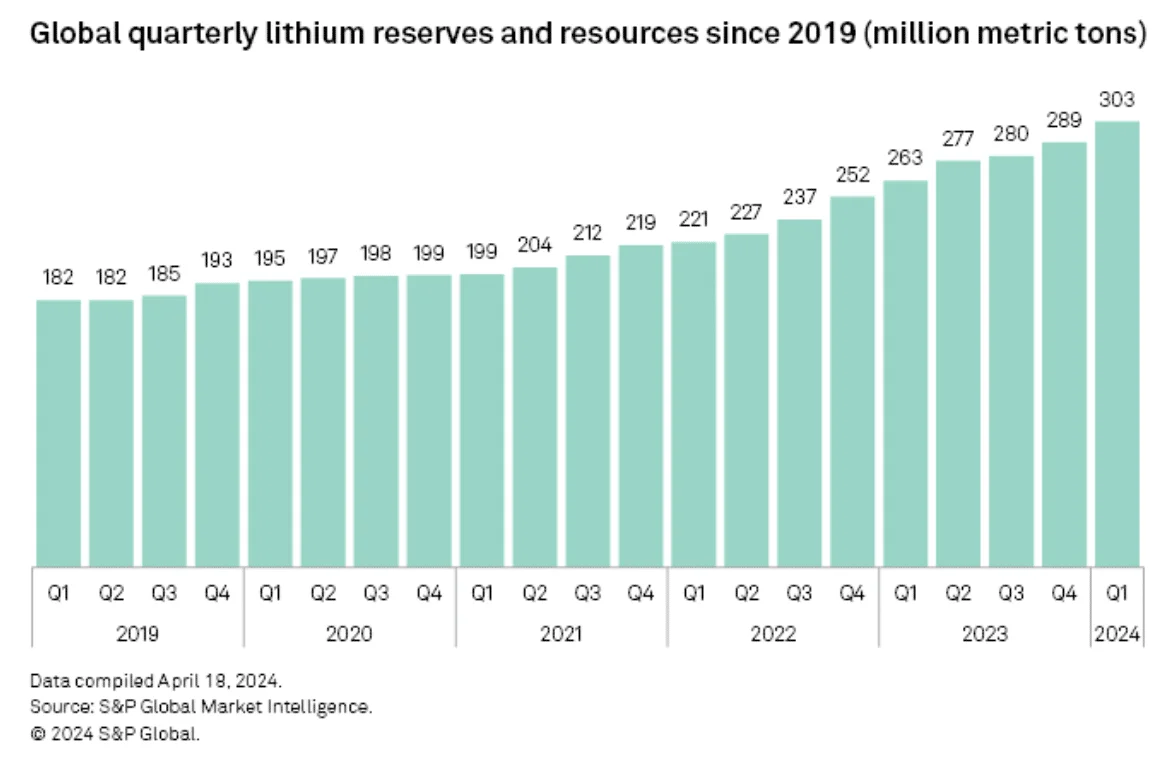

The demand for lithium remains robust in 2024, driven by the rapid adoption of EVs and the expansion of renewable energy infrastructure. Major economies such as the U.S., Europe, and China are accelerating their transition to electric mobility, further increasing the need for lithium. Global lithium demand is projected to surpass supply this year, pushing prices higher and stimulating investment in new mining projects.

The global EV market continues its exponential growth, with companies like Tesla, BYD, and Volkswagen leading the charge. In 2024, EV sales are expected to exceed 20 million units globally, with China, Europe, and the U.S. being the largest markets. Lithium-ion batteries are at the core of this revolution, and automakers are securing long-term lithium supply contracts to meet their production needs.

Regional Focus: Key Players and Developments

China: Dominating the Lithium Ecosystem

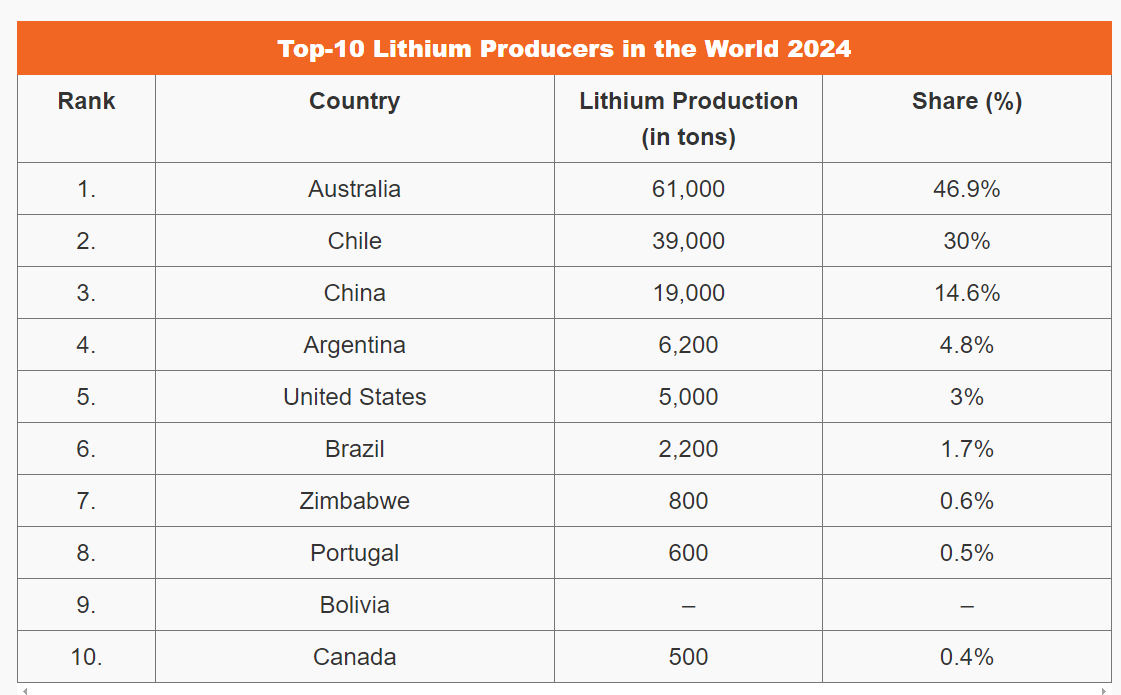

China remains the undisputed leader in the global lithium industry, controlling significant portions of the supply chain from mining to battery manufacturing. Strategic investments in global lithium resources and advanced manufacturing capabilities have cemented China’s dominance.

According to the Diplomat newspaper, August 21, 2024, during China’s long-awaited Third Plenum in July, Chinese President Xi Jinping confirmed that Beijing is focusing on new quality productive forces. The foundation of Xi’s new productive forces is the “new three” – EVs, lithium-ion batteries, and solar photovoltaics (PV). These are industries that are still emerging, but already have an immense economic impact, and all three are largely controlled by Chinese companies.

Ganfeng Lithium, one of the world’s largest lithium producers, continues to expand its global footprint with investments in lithium mining operations in Argentina, Australia, and China. This vertical integration ensures a steady supply of raw materials for China’s battery industry, which powers much of the global EV market.

CATL, China’s leading battery manufacturer, is at the forefront of the global battery industry. In 2024, the company continues to innovate, focusing on increasing the energy density of its batteries while reducing costs. CATL’s batteries power a significant portion of the world’s EVs, including those made by Tesla, NIO, and other leading automakers.

Regarding the processing capacity, China is the global leader in lithium processing, meaning that even if lithium is mined elsewhere (e.g., Australia, South America), a significant portion of it is sent to China for processing into lithium chemicals used in batteries. Beyond just raw lithium production, China dominates the entire lithium-ion battery supply chain. This includes the refining of lithium, manufacturing of battery components, and production of EV batteries. To secure its lithium supply, China has also invested heavily in lithium projects abroad, particularly in the Lithium Triangle (Argentina, Bolivia, Chile) and in Australia. This strategy ensures a steady supply of raw lithium to feed its domestic processing industry.

In summary, while China is a major lithium producer, its real strength lies in its dominance of the global lithium supply chain, from raw material extraction to battery production.

Australia: Leading Lithium Producer

Australia is the world’s largest lithium producer, primarily through hard rock mining of spodumene. The country’s stable political environment and rich resources make it a cornerstone of the global lithium supply chain.

The Greenbushes mine, operated by Talison Lithium, is one of the world’s largest and highest-grade sources of lithium. In 2024, the mine continues to be a critical supplier of spodumene concentrate to lithium refiners globally, particularly in China.

Pilbara Minerals, another major lithium producer in Australia, has been expanding its production capacity at the Pilgangoora mine. The company is also exploring downstream processing options within Australia to add more value before exporting lithium products.

McKinsey’s article Australia’s potential in the lithium market, June 2023, pretends that the demand for lithium-based power will rise rapidly with the growth of the EV market. Australia has a unique opportunity to make the most of it.

United States: Securing Strategic Resources

The U.S. is focused on strengthening its lithium supply chain to support its EV industry and reduce reliance on foreign sources. The government has classified lithium as a critical mineral, leading to increased investment in domestic mining and processing.

The Thacker Pass lithium project in Nevada, developed by Lithium Americas, is one of the largest lithium resources in the U.S. Set to begin production in the coming years, this project will play a crucial role in supplying lithium to the U.S. battery industry, particularly for automakers like Tesla and General Motors.

Tesla is expanding its battery production capabilities with gigafactories in Nevada and Texas. The company is also exploring direct involvement in lithium mining to secure raw materials for its batteries, reflecting a broader trend of vertical integration among major automakers.

Latin America: The Lithium Triangle

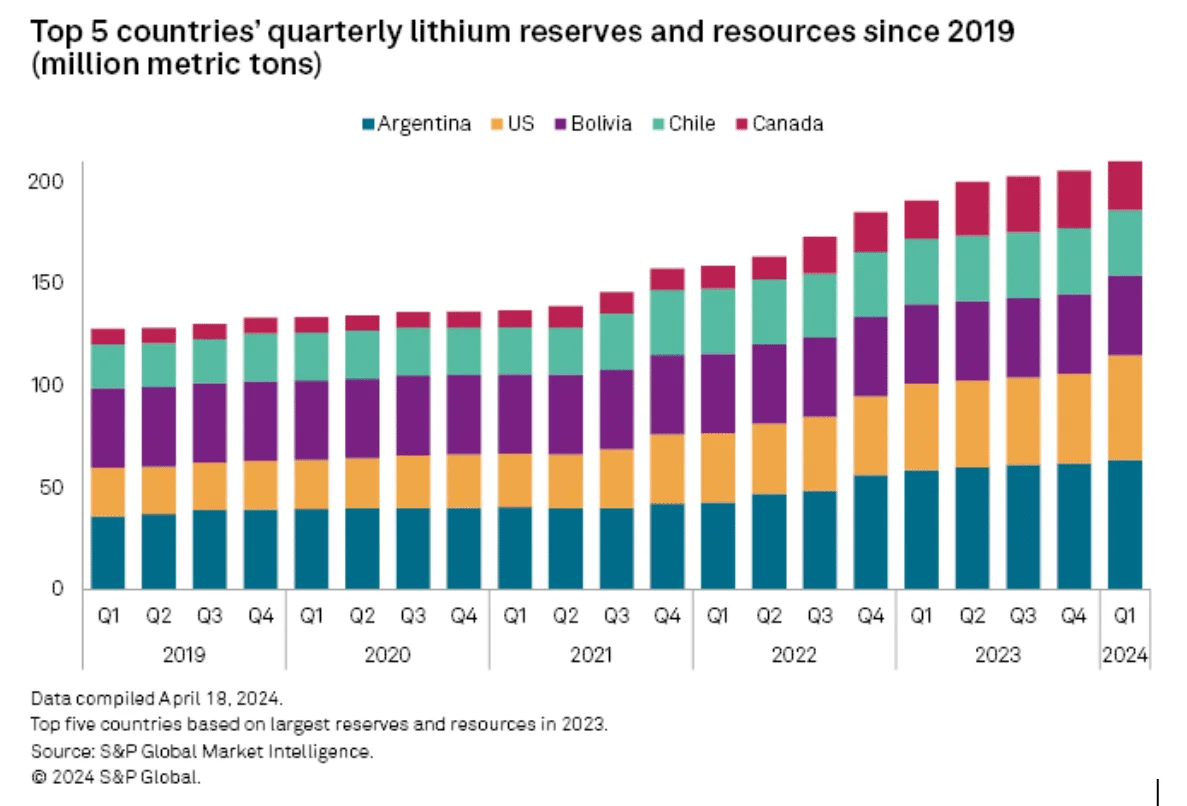

The Lithium Triangle, encompassing Argentina, Bolivia, and Chile, holds the world’s largest lithium reserves. These countries are critical suppliers, particularly in the form of lithium brine.

SQM (Sociedad Química y Minera de Chile) is one of the leading lithium producers globally, operating extensive lithium brine extraction operations in the Atacama Desert. In 2024, SQM continues to expand its production capacity to meet the growing global demand for lithium.

Argentina is rapidly increasing its lithium production, with several projects coming online in 2024. Livent Corporation and Allkem (formerly Orocobre) are key players in Argentina’s lithium industry, focusing on sustainable extraction methods to minimize environmental impact.

As of Bolivia, it remains a central player in the Lithium Triangle, particularly because of its vast lithium reserves located in the Salar de Uyuni, the world’s largest salt flat.

In 2024, Bolivia continues its strategy of nationalizing its lithium industry. In January, the country signed a landmark agreement with a consortium of Chinese and German companies. The partnership, managed through the state-owned company Yacimientos de Litio Bolivianos (YLB), aims to build a new lithium extraction plant in Uyuni. This plant will utilize Direct Lithium Extraction (DLE) technology, which is more efficient and environmentally friendly compared to traditional methods. Despite these advancements, Bolivia faces significant hurdles in scaling up production. Infrastructure challenges, political instability, and the complexities of extracting lithium from brine have slowed progress. Nonetheless, Bolivia’s strategy of balancing national interests with foreign investment in lithium extraction reflects its ongoing efforts to become a key player in the global lithium market while safeguarding national sovereignty over its resources.

Europe: Building a Self-Sufficient Supply Chain

Europe is striving to establish a self-sufficient lithium supply chain as part of its broader green transition. The European Union’s ambitious climate goals and the rapid adoption of EVs are driving the demand for lithium-ion batteries.

Northvolt, a Swedish battery manufacturer, plays a crucial role in Europe’s battery supply chain. The company has secured significant funding and supply agreements with automakers like BMW and Volkswagen. Northvolt’s gigafactory in Sweden is among the largest in Europe, focusing on producing sustainable batteries with a high percentage of recycled lithium.

Recently, the European Union has made a significant move towards securing its lithium supply by partnering with Sibanye-Stillwater through its Keliber lithium project in Finland.

The European Investment Bank (EIB) is providing €150 million to support Keliber Oy’s development, part of a €500 million project by Sibanye-Stillwater, a mining and battery chemicals company. This investment underscores lithium’s crucial role in the EU’s green transition and its move towards strategic autonomy in battery material production.

The agreement was facilitated by the InvestEU programme, which looks to mobilize over €372 billion in additional investments from 2021 to 2027. The programme consolidates various EU financial instruments to back sustainable recovery and growth, aligning with the European Green Deal and the digital transition. By leveraging public and private funds, the InvestEU programme plays a crucial role in backing impactful investment projects across Europe.

Technological Innovations and Environmental Concerns

In 2024, technological advancements in lithium extraction and battery technologies continue to shape the industry. Direct lithium extraction (DLE) methods are gaining traction, promising to reduce environmental impacts and increase efficiency. Meanwhile, research into alternative battery chemistries, such as solid-state and lithium-sulfur batteries, is ongoing, though commercial viability at scale remains a few years away.

The environmental impact of lithium mining, particularly in South America’s Lithium Triangle, is a critical concern. Water usage in lithium brine extraction is under scrutiny due to its effects on local ecosystems and communities. Companies are under increasing pressure to adopt more sustainable practices and engage in transparent, ethical sourcing.

Geopolitics plays a significant role in the lithium market in 2024. The global race to secure lithium resources has intensified, with countries and companies vying for control over supply chains. Trade tensions, particularly between the U.S. and China, continue to influence market dynamics, affecting pricing, investment, and technological collaboration.

Rio Tinto’s Jadar Project in Serbia, one of Europe’s largest potential lithium mines, exemplifies the geopolitical complexities of the lithium industry. The project has faced significant local opposition due to environmental concerns, reflecting the broader challenges of balancing resource development with sustainability.

Looking ahead, the lithium market in 2024 is marked by both opportunities and challenges. While demand growth is expected to continue, driven by the electrification of transport and energy, supply chain constraints, environmental concerns, and geopolitical complexities will require careful navigation. The ongoing evolution of battery technology and sustainability practices will be key determinants of the industry’s trajectory in the coming years.

Partner with INCONCRETO and its experts to tap into the booming lithium market. As clean energy takes center stage, understanding and managing the challenges of

the lithium industry is vital for continued growth. We help you navigate these changes, ensuring your investments in lithium and battery technologies are smart and profitable.

With our guidance, you can succeed in this fast-growing

market and contribute to a more sustainable future.

For further readings, you may consult these sources

- https://www.nasdaq.com/articles/lithium-market-update-q2-2024-review

- https://www.weforum.org/agenda/2024/06/jumpstarting-lithium-battery-recycling-investing-innovation/

- Lithium Prices and The Insights into the EV Market’s Pulse

- https://carboncredits.com/global-lithium-reserves-and-resources-surge-52-in-q1-2024/

- https://www.reuters.com/world/europe/scores-central-serbia-rally-against-rio-tintos-lithium-project-2024-08-19/

- https://carboncredits.com/understanding-lithium-prices-past-present-and-future/

- https://thediplomat.com/2024/08/controlling-tomorrow-chinas-dominance-over-future-strategic-supply-chains/

- https://www.mckinsey.com/industries/metals-and-mining/our-insights/australias-potential-in-the-lithium-market

- https://www.tesla-mag.com/en/eu-teams-up-with-sibanye-stillwater-to-boost-lithium-production-in-finland-for-battery-resilience/

- https://investeu.europa.eu/investeu-programme_en

- https://currentaffairs.adda247.com/top-10-lithium-producing-countries-in-the-world/

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM