INCONCRETO NEWS

The wonderful (and technical) adventure of microprocessors

The microprocessor, also known as the Central Processing Unit (CPU), is the brain of all computers. A kind of miniature electronic device that contains the arithmetic, logic, and control circuitry necessary to perform the functions of a digital computer’s central processing unit. Computer systems aren’t the only devices that use microprocessors. Everything from smartphones to household appliances (e.g., microwaves) to cars use microprocessors these days.

In the early 1970s, the introduction of large-scale integration (LSI)—which made it possible to pack thousands of transistors, diodes, and resistors onto a silicon chip less than 0.2 inch (5 mm) square—led to the development of the microprocessor. The first microprocessor was the Intel 4004, introduced in 1971 and priced at US$60 (equivalent to $400 in 2021). This chip was designed by a team consisting of Italian engineer Federico Faggin, American engineers Marcian Hoff and Stanley Mazor, and Japanese engineer Masatoshi Shima. The 4004 was not very powerful, it was primarily used to perform simple mathematical operations in a calculator called “Busicom”. But it wasn’t until the 80s that computers entered our homes making a real impact on the average person’s life – thanks to the microprocessor. It was indeed the successful development of the microprocessor that led to the home computer.

During the early 1980s, very large-scale integration (VLSI) vastly increased the circuit density of microprocessors. In the 2010s a single VLSI circuit holds billions of electronic components on a chip identical in size to the LSI circuit.

General purpose microprocessors are what allows our computers to be used for text editing, multimedia display, computation, and communication over the Internet. Because of how fast, small, and energy-efficient they are, they have been integral to the development of everyday technology. Since the microprocessor basically changed the world, it’s worth understanding what it is and how it functions!

Evolution of Microprocessors

We can categorize microprocessors according to the generations or according to their size:

- First Generation (4 – bit Microprocessors)

The first-generation microprocessors were introduced in the year 1971-1972 by Intel Corporation. It was named Intel 4004 since it was a 4-bit processor. It was a processor on a single chip. It could perform simple arithmetic and logical operations such as addition, subtraction, Boolean OR and Boolean AND.I had a control unit capable of performing control functions like fetching an instruction from storage memory, decoding it, and then generating control pulses to execute it.

- Second Generation (8 – bit Microprocessor)

The second-generation microprocessors were introduced in 1973 again by Intel. It was a first 8 – bit microprocessor which could perform arithmetic and logic operations on 8-bit words. It was Intel 8008 and another improved version was Intel 8088. Other processors like Motorola 6800 and 6801 etc. came into existence.

- Third Generation (16 – bit Microprocessor)

The third-generation microprocessors, introduced in 1978 were represented by Intel’s 8086, Zilog Z800 and 80286, which were 16 – bit processors with a performance like minicomputers.

- Fourth Generation (32 – bit Microprocessors)

Several different companies introduced the 32-bit microprocessors, but the most popular one is the Intel 80386.

- Fifth Generation (64 – bit Microprocessors)

From 1995 to now we are in the fifth generation. After 80856, Intel came out with a new processor namely Pentium processor followed by Pentium Pro CPU, which allows multiple CPUs in a single system to achieve multiprocessing.

Other improved 64-bit processors are Celeron, Dual, Quad, Octa Core processors.

Source : https://www.javatpoint.com/microprocessor-introduction

Here are a few reasons why microprocessors are so widely used :

- Low Cost

Due to their use of IC technology, microprocessors don’t cost much to produce. This means that the use of microprocessors can greatly reduce the cost of the system it’s used in.

- High Speed

The technology used to produce modern microprocessors has allowed them to operate at incredibly high speeds–today’s microprocessors can execute millions of instructions per second.

- Low power consuming

Power consumption is much lower than other types of processors since microprocessors are manufactured using metal oxide semiconductor technology. This makes devices equipped with microprocessors much more energy efficient.

- Versatile

The same microprocessor chip can be used for numerous applications as long as the programming is changed, making it incredibly versatile.

- Small size

A microprocessor is fabricated in a very less footprint due to very large scale and ultra large-scale integration technology. Because of this, the size of the computer system is reduced.

- Less Heat Generation

Microprocessors uses semiconductor technology which will not emit much heat as compared to vacuum tube devices.

- Reliable

Because semiconductor technology is used in the production of microprocessors, their failure rate is extremely low.

- Portable

Due to how small microprocessors are and that they don’t consume a lot of power, devices using microprocessors can be designed to be portable (like smartphones).

Categories of Microprocessors

Microprocessors can be classified in different categories, as follows:

- Based on Word Length

Microprocessors can be based on the number of bits the processor’s internal data bus or the number of bits that it can process at a time (which is known as the word length). Based on its word length, a microprocessor can be classified as 8-bit, 16-bit, 32-bit, and 64-bit.

- Reduced Instruction Set Computer (RISC)

RISC microprocessors are more general use than those that have a more specific set of instructions. The execution of instructions in a processor requires a special circuit to load and process data. Because RISC microprocessors have fewer instructions, they have simpler circuits, which means they operate faster. Additionally, RISC microprocessors have more registers, use more RAM, and use a fixed number of clock cycles to execute one instruction.

- Complex Instruction Set Computer

CISC microprocessors are the opposite of RISC microprocessors. Their purpose is to reduce the number of instructions for each program. The number of cycles per instruction is ignored. Because complex instructions are made directly into the hardware, CISC microprocessors are more complex and slower. CISC microprocessors use little RAM, have more transistors, have fewer registers, have numerous clock cycles for each instruction, and have a variety of addressing modes.

- Special Purpose Processors

Some microprocessors are built to perform specific functions. For example, coprocessors are used in combination with a main processor, while a transputer is a transistor computer: a microprocessor that has its own local memory.

In simple words, the microprocessor or chip is the engine or the brain of the computer that goes into motion when the computer is switched on. Microprocessor-based systems are thus found everywhere today and not just in computers and smartphones but also in automatic testing of products, speed control of motors, traffic light control, communication equipment, television, satellite communication, home appliances, such as microwave oven, washing machine, gaming controller, industrial controllers and even specialised applications such as military applications.

The geography of microprocessor industry

As said before, Intel manufactured the first microprocessor — the 4004 — in 1971. By today’s standards, this device was extremely slow and difficult to program because only four bits of data or programming code could be handled at a time. Since then, according to Acumen Research and Consulting recently published report “The Global Microprocessor Market Size accounted for USD 111.3 Billion in 2021 and is estimated to achieve a market size of USD 163.8 Billion by 2030 growing at a compound annual growth rate (CAGR) of 4.5% from 2022 to 2030”.

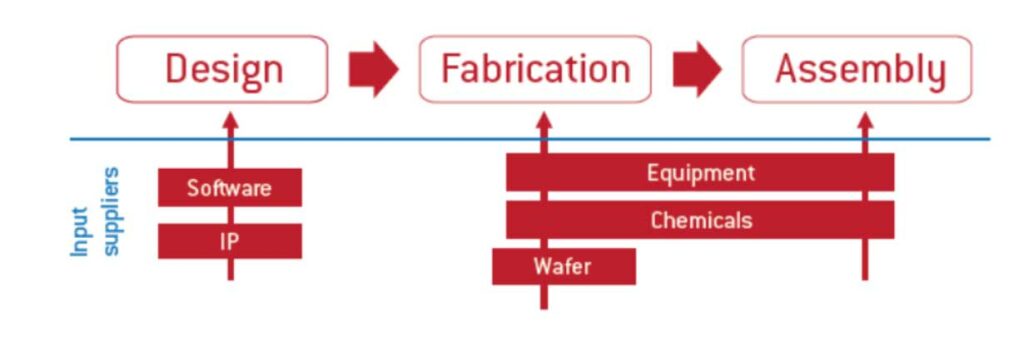

The production of chips can be divided into three steps:

- Design, which means specifying the layout and features

- Fabrication, put in place in manufacturing foundries

- Assembly, ensured by testing and packaging of chips before they can be put into hardware

Few recent geographic studies have focused on how market dynamics might explain macroregional shifts in industrial production.

Evolving from the earlier trends toward internationalization and the rise of Japan as a serious contender to American leadership, the global semiconductor industry has undergone significant geographic shifts since the 2000s. The global center of gravity for integrated circuits (IC) manufacturing or fabrication, known as chip making, has shifted much further toward East Asia.

Based on the three steps mentioned above, two main business models have started co-existing since that moment: ‘integrated design manufacturers’ (IDM), such as Intel, which both design and fabricate chips. In the ‘pure foundry’ model, only-design firms (also known as ‘fabless firms’) and foundries collaborate, as it is the case today for the leading ‘pure foundry’ firm worldwide, the Taiwanese firm TSMC. Finally, the assembly of chips usually takes place in standalone firms.

By the late 2010s, East Asia accounted for over 80 percent of worldwide IC fabrication capacity, up from 60 percent in 2000 (almost half in Japan, then the world’s largest producer). In 2018, Taiwan and South Korea became the two largest producers, together accounting for 45 percent of world capacity. Chip-making capacity in China and Singapore was respectively larger than the US and Europe.

Today the global semiconductor industry is dominated by companies from the United States, Taiwan, South Korea, Japan and the Netherlands. Aside from that, North America is predicted to grow moderately during the projection period. The increase is linked to the considerable presence of important firms in the region, including Qualcomm Technologies Inc., Intel Corporation, as well as Texas Instruments Inc. In the current context, the United States leads the American market. Additionally, the continued advancement of consumer technology items, medical monitoring systems, and hybrid and electric automobiles is a major driver of market expansion in the United States.

The U.S., because of its dominance in chip design and chip manufacturing machinery, also has the leverage to enforce global sanctions against unpopular competitors. Huawei is taking a hard hit, with its smartphone division in particular suffering. However, Washington’s export bans also hurt its domestic suppliers – and thus their ability to invest in maintaining their leading position in the market.

The crisis of the microprocessors industry in 2020-2022

The complexity of the production process

After many years which led to the consolidation of this production process, at the end of the 2010s the microprocessors industry, in spite of continuing to flourish, started showing sign of yielding.

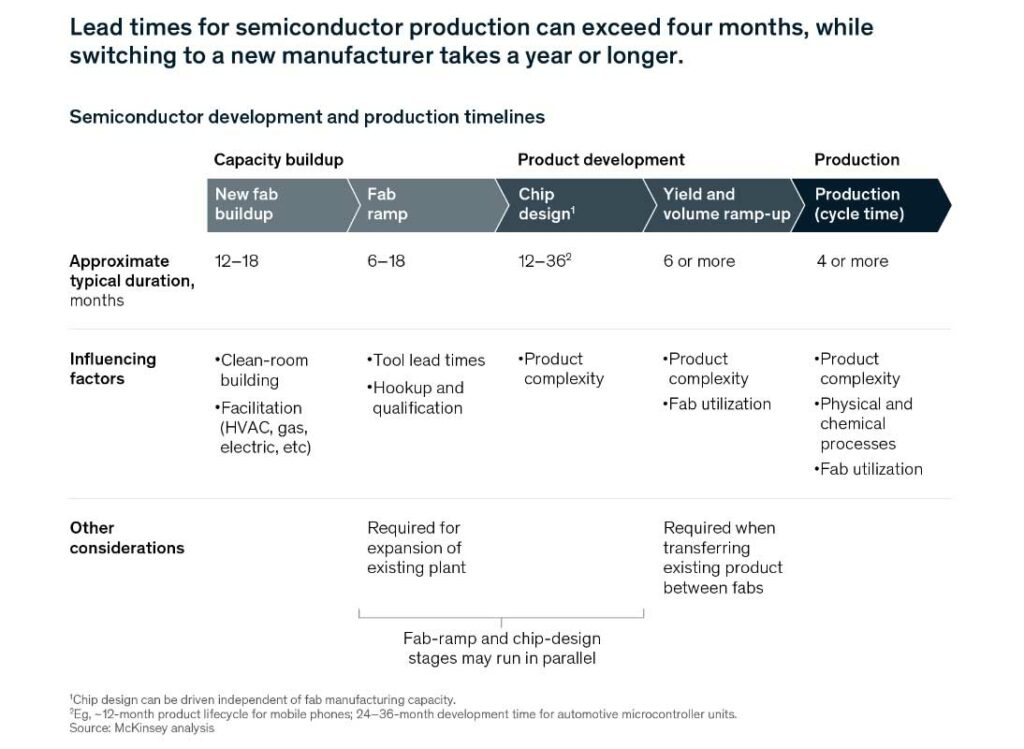

As a study conducted by McKinsey recently showed, the reason for such occurring can be found in the characteristics of the production process for these components, whose complexity has increased over the years. In fact, typical lead times can exceed four months for products that are already well established in a manufacturing line. Increasing capacity by moving a product to another manufacturing site usually adds another six months (also considering existing plants). Moreover, if it comes up to be necessary to switch to a different manufacturer, this typically adds another year or more because the chip’s design requires alterations to match the specific manufacturing processes of the new partner – needless to say, some chips can contain manufacturer-specific intellectual property that may require alterations or licensing triggering further delay.

Historically, the structure of the microprocessors market is very fragmented: no company owns more than a 15% share globally. This clear division has constantly led companies to specialize and provide specific parts for individual industries.

While this feature of the market contributes to alleviate some of the production issues, some components are often missed, and manufacturers are not in the capacity to ship out final products. Core technologies are always available, but normally no single company has the size or means to provide all the resources for a fully integrated supply chain system.

Microprocessors supply chains have been designed based on a lean manufacturing model, which can ensure that it becomes efficient and effective. The downside of this structure is the high risk for the supply chain to be extremely exposed to rapid and unexpected changes in the market. Even if the industry has tried to make some steps towards vertical consolidation over the last years, supplier interdependence remains essential for the traditional way of production. As an example, microcontroller chips take months to produce, provoking a raise in the overall production times for cars, smartphones, and other applications.

Moreover, chip factories are usually built around large plants: they need huge ancillary services in terms of energy and water, and they are very high-tech. These characteristics make inevitable that any new project for more integrated supply chain is conceived and deployed where massive funds are available for this purpose, that is, where Governments decide to allocate public funds to attract private capitals for developing new projects.

In this framework, semiconductors represent a crucially strategic issue for States: this has longer been evident and even more when back in 2018 former U.S. President Donald Trump intervened on the international market, regulating sales of American-designed chips to Chinese firms such as Huawei, ZTE, and others. Since then, Chinese chip makers were banished in the U.S. and American businesses were left without any certain source of microprocessors.

The impact of the pandemic on the Asian industry

Then, the Covid-19 pandemic started in late 2019 in China and it quickly spread all over the world. It was the killing blow for the microprocessors industry, which had been facing internal problems, such as insufficient capacity at semiconductor fabs, for a long time before that moment. The sanitary crisis led to the long series of lockdowns, which spread from Asia and progressively to all the continents. The immediate consequence of these unprecedented lockdowns was represented by the closure of many high-level technological factories in this part of the world, particularly reducing the availability of microprocessors – or at least modifying the scope of their production. This shortage of processing components had knock-on effects for other markets, including automotive, cryptocurrency, and smartphones.

The example of the automotive sector is clearly telling. In early 2020, automakers, expecting a decrease of the demand for vehicles, cut their chip orders: in fact, cars sales declined as much as 80% in Europe, 70% in China and nearly 50% in the United States. Subsequently, orders for semiconductors, which are used in innumerable applications, including in fuel-pressure sensors, digital speedometers, and navigation displays, dropped off precipitously. Therefore, the chips industry shifted production lines to meet demand for other applications.

In fact, the need for more digital connectivity arose at a time when meeting in person was not possible: much of the workforce transitioned to a work-from-home setup, while most consumers were stuck at home, looking for intensified forms of distant-communication. The result was a great growth in the demand of personal computers, laptops, tablets, servers, equipment for wired communications and even backup computing devices to ensure people could work properly. Also, the requests of entertainment devices such as gaming consoles and Smart TVs grew. All these tools are heavily dependent on microprocessors.

That meant that even as the auto industry drastically cut chip orders and suddenly asked again for them, in parallel other sectors faced an increased need in comparison to the previous demand they were suited to.

When demand for microprocessors coming from the automotive industry recovered faster than anticipated in the second half of 2020, their availability was limited. The shortage further strained because this increased demand for high-end automobiles became more affordable thanks to stable lower interest rates.

In the following months, it became even more complicated for the major manufacturers of semiconductors to keep up with demand, since the delay in the restart of the market caused other considerable delays.

In summer 2021, international observers expected this crisis to be over by Christmas – yet it continued, and the goal moved to last spring, then again to summer 2022. However, in the meantime, it has become clear that the problem is no longer only linked to the mismatch between demand and supply in the automotive industry and to the mistake made by the car manufacturers who had miscalculated their orders for microprocessors with the closure of Asian factories for Covid.

The instability coming from geopolitical tensions

One of the most emblematic reasons can be identified in the geopolitical tensions which rouse this year. The Russia-Ukraine conflict has left once again manufacturers without raw materials to produce chips: on one side, Ukraine supplies 25 to 35% of the world’s purified neon gas, and Russia is one of the biggest producers of palladium, both these resources being essential to produce microprocessors. On the top of that, when the international logistics was slowly coming back to normality after the beginning of the pandemic, the war has delayed it and transportation costs have exploded.

Finally, in August this year, as a result of a long-lasting escalation of political tensions between the US and China, the crisis of Taiwan erupted. The U.S. has been worrying about the fact that Taiwan, the sole source of advanced semiconductor microchips, could threaten the country’s national security. Due to the global microchip shortage, the American economy lost $240 billion in 2021, and a war over Taiwan would be even more catastrophic for the U.S. due to its reliance on one single supplier, Taiwan Semiconductor Manufacturing Company (TSMC).

A wave of “reshoring” of microprocessors production in Western countries

These shocks on the international market of microprocessors are leading to a phenomenon of reshoring of the production, which is being led by various western countries, starting from the U.S. and the European Union. Such new vague of industrial reshoring is based on the tentative to put in place a technological revolution.

The “chiplets” potentially leading a revolution in the industry

Over the last years, the Tech industry observed that the fundamentals of the Moore law are no more entirely applicable. The Moore law states that approximately every two years, the number of transistors on microchips is expected double. This suggests that increasing the density of transistors per unit area is possible through more advanced processes. However, since the cost of monolithic integration continues to rise, many companies have begun to explore other options, aiming at confirming the applications of the Moore law.

At present, the industry is working deeply investing in advanced packaging technology which could put multiple advanced or mature “chiplets” in one package – developing the so-called heterogeneous integration –, together with 3D packaging, to expand at the system level.

For cost and yield considerations, a feature-rich and large-area chip die can be split into multiple small chips. Each of them is a chiplet, a pre-produced circuit block that is conceived for a very specific function. These small chips, once combined together, can achieve higher functionalities and with the help of Advanced integration technologies (such as 3D packaging) are subsequently integrated and packaged together to form a system chip.

Such scenario opens the way for all technological processors to be built on chip components coming from multiple vendors: the new Universal Chiplet Interconnect Express specification (UCle 1.0 specification) is designed to help make this happen.

Launched in March 2022, the UCIe 1.0 specification provides a complete standardized die-to-die interconnect with physical layer, protocol stack, software model, and compliance testing. As stated by the alliance which conceived it, “the specification leverages the established PCI Express® (PCI-SIG®) and Compute Express Link™ (CXL™) industry standards. It will enable end users to easily mix and match chiplet components from a multi-vendor ecosystem for System-on-Chip (SoC) construction, including customized SoC”.

Since its foundation, the Consortium gathers multiple stakeholders of the market, including Advanced Semiconductor Engineering Inc. (ASE), AMD, Arm, Google Cloud, Intel Corporation, Meta, Microsoft Corporation, Qualcomm Incorporated, Samsung Electronics, and Taiwan Semiconductor Manufacturing Company. Two newly-elected Board members, Alibaba and NVIDIA, were unveiled in August 2022. All the participants are firmly committed to advancing the UCIe specification in order to establish a chiplet ecosystem and future generations of chiplet technologies.

“The age of chiplets has truly arrived,” said Lihong Cao, a director at Taiwan’s Advanced Semiconductor Engineering. “We are confident that UCIe will play a pivotal role in enabling ecosystem efficiencies, by lowering development time and cost through open standards for interfaces between various intellectual properties.”

As regards the strength of the new trend for the microprocessors industry focusing on chiplets, Intel Corporation is one of the companies which has anticipated it the most. The group has spent the last few years trying to balance out the weight of its operations in Asia, while the geopolitical tensions between the U.S. and China progressively grew. In this context, Costa Rica, just at three-hour flight from Miami, was selected by Intel Corporation as the best choice for the establishment of a local semiconductor production. More precisely, it was a reactivation: after that the group had shifted its manufacturing operations to Asia in 2015 – taking away an activity that accounted for 20% of Costa Rican exports – and as a result of the current international tensions, it decided to reboot the Costa Rican plant again in 2020 with an announced investment of $350 million. This year, such operation ended up growing to $1 billion, including a 60% increase in staff to nearly 4,000 workers, and even more expansion plans for what may come in the future, with the ambition to make it a capital center for chiplets.

The CHIPS and Science Act: an effective roadmap launched by the U.S.

In the design of a new path for the microprocessors industry, the U.S. is the country which positioned itself the most for guaranteeing a secure success. In this case, it is possible to witness a positive twine of actions conducted both by the private and the public sector in the last years, but especially in 2022.

Many U.S. firms are dependent on chips made abroad, and the fragility of those supply chains has been revealed over the past 18 months, when – according to McKinsey – global supply chain pressures remained around 2,5 standard deviations away from normal operations.

With the federal Government encouraging them greatly, the ambitions of some large groups of this sector, such as Intel Corporation, Samsung, and TSMC, have unveiled plans for a flurry of new US fabrication plants. Qualcomm Incorporated, in partnership with GlobalFoundries, also said it would invest $4.2 billion to double chip production in its New York fabrication facility, with the aim to increase semiconductor production in the U.S. by up to 50 percent over the next five years. Moreover, Micron Technology announced it will invest $40 billion to build the largest-ever U.S. semiconductor factory, concentrating the production on memory chips, critical for computers and electronic devices, which will create up to 40,000 new jobs. As the White House estimates, this investment alone will bring the U.S. market share of memory chip production from less than 2 percent to up to 10 percent over the next decade.

These aspiring and visionary projects are part of the national plans that President Biden has conceived in favour of the promotion of local semiconductor production, which is seen as a key element for the U.S. economy and security.

In fact, the new fabrication plant projects defined and implemented recently by the semiconductor manufacturers are coherent with the CHIPS and Science Act of 2022 signed into law by President Biden in August. Essentially, the CHIPS Act is an attempt to increase the percentage of microprocessors produced in the US by closing the cost differential with other countries such as Taiwan, South Korea, and China. In all those nations, Governments are already subsidizing semiconductor manufacturers.

The legislation seeks to jump-start R&D and commercialization of leading-edge technologies, such as quantum computing, AI, clean energy, and nanotechnology, but it also intends to create new regional high-tech hubs and a bigger, more inclusive science, technology, engineering, and math (STEM) workforce. More precisely, this Act is designed to foster U.S. competitiveness, creativity, and innovation, as well as national security, with the aim to clearly catalyse investments in domestic semiconductor manufacturing capacity.

This is why the CHIPS Act directs $280 billion in spending over the next ten years. The majority – around $200 billion – is dedicated to scientific R&D and commercialization. Some $52.7 billion is allocated for semiconductor manufacturing, R&D, and workforce development, with another $24 billion worth of tax credits for chip production. There is also $3 billion reserved for programs targeted at leading-edge technology and wireless supply chains.

The challenge is clearly understood, and a possible solution has been designed through reshoring. To achieve change, the U.S. are ready to build a considerable legacy and leading-edge foundry capacity to meet the demand of U.S. fabless chip companies. It is evident that the task won’t be completed rapidly, but deploying a new system, capable to compete with manufacturing in the overseas foundries. In this sense, R&D and related investments, also in alternatives like chiplets, represent a unique opportunity.

The EU Chips Act: the tool for EU digital sovereignty

In the Old Continent as well, in February 2022 the European Commission has published a proposal for a European Chips Act as the European Union’s response to the challenges in the industry, under the guideline ‘Strengthen EU digital sovereignty’. As it has happened in the United States, this proposal for legislation calls for massive investments by European Governments and private companies in the microprocessors manufacturing and is willing to ensure the greatest possible autonomy for these technological tools, so fundamental in all kinds of industries. It is planned to pool 43 billion euros by 2030 with the aim of doubling the European market share in the world (i.e. bringing it back to around 20%), which means, in fact, quadrupling the current levels of production.

Nevertheless, unlike the U.S., the European legislation process on the subject is still ongoing: the European Commission’s proposal is at the moment being analysed by the European Parliament and by the Council of the European Union: once their position is defined, trialogues between the Commission, the Council and the Parliament will be opened, to finalise and vote a common text in 2023.

The EU Chips Act is organised around three main pillars:

- A ‘chips for Europe initiative’, which declines the importance of supporting R&D in Europe and bringing innovation ‘from the lab to the fab’;

- ‘Security of supply’, by attracting investment, enhancing production capacities and providing the legal basis for EU member states to use subsidies as a driver to attract and promote cutting-edge manufacturers;

- ‘Monitoring and crisis response’, a framework with trade measures to intervene in the supply chain in times of emergency.

Probably the most important part of this strategy is represented by the second pillar, which focuses on the development of foundries. In this framework, the Commission sets up a new exemption to allow EU countries to provide dedicated subsidies for companies so that they can build high-end foundries without strict limitations of subsidized amounts. The uniqueness of such exemption must be underlined here, since it is not common at all for the European Union to authorize Governments to grant national subsides and this rule would be specifically created and applied to this case.

These investments will represent the highest amount, since it is estimated that the cost for a new high-tech foundry can exceed $10 billion. Under the rules set out for Important Projects of Common European Interest (IPCEI projects), only research, development and innovation projects leveraging cutting-edge technologies can be financed, fulfilling the condition that they would not be financeable by the private sector alone.

The first project benefiting from this rule has already been announced. A new Intel Corporation foundry is going to be built in Magdeburg, Germany: the planned investment is €17 billion, 40% of which will be funded by the German Goverment. With a truthful European approach, in total three plants will be built: not only the foundry in Germany, but also a packaging plant in Italy and a design and engineering plant in France.

This configuration will ensure that all parts of the supply chain will have to be brought back to Europe: foundries, design and packaging. Something that will have to be applied as well to other European companies, which are indeed well positioned at the global level in terms of capitalization, but lack of a complete supply chain around them.

As highlighted by an analysis conducted by the Italian online newspaper Linkiesta, the Italian-French ST Microelectronics, which is certainly one of the most important companies in the production of microprocessors for the automotive and automation sector, has still a long way to go. The group designs its chips for the automotive and industry 4.0 in Italy and in France, but it produces them partly in Europe and partly in its foundries in Morocco, in Malaysia, in the Philippines and in China. Furthermore, it has almost entirely relocated the testing and packaging phases to Malaysia, where occurs the assembly of the chips produced. For this reason, in the last year and a half ST Microelectronics has been exposed to all the consequences which came from the closures of factories and ports due to the Covid-19 pandemic. And in any case, it buys a 20% smaller chip size from the world number one, the Taiwanese company TSMC, which can count among its clients the worldwide elite of hi-tech, from Apple and Intel Corporations down.

The shift will not be immediate: it is fundamental to completely reimagine the levels of integration of the supply chain. The time for the construction of a “greenfield” foundry, i.e. beginning from scratch, is about three years.

ST Microelectronics is now starting the production in its new plant in Agrate, in Lombardy, Italy: the overall project was initiated in 2018, before the crisis. The original cost, of €2 billion, has already risen to €3 billion, and that is due to the great space requirements of these productions and the high urbanization typical of Italy, the plant develops over a large part underground, consolidated by 1,600 specific equipment to eliminate the vibrations that can disturb production.

It is an integrated plant, it even has the foundry to produce chips, with a large clean room and the aseptic rooms where the chips are produced. To bear the costs, ST Microelectronics has launched a partnership with the Israeli Tower Semiconductors, number 10 of foundries worldwide, just acquired by Intel, which will occupy 50% of the clean room. In the rest of the plant, ST Microelectronics will produce chips for the next generation automotive, those for electric cars and self-driving cars.

Another investment will be in Grenoble, France, where ST Microelectronics plant is expanding one of its plants, this time in partnership with the American Global Foundries, the world’s number 4.

A glimpse into the future: a new equilibrium in microprocessors industry

In this attempt to change the international equilibrium of the microprocessors industry, the Western countries aiming to obtain the autonomy in this field have to take into account what is being put in place by those who have been the leaders on the market in the last decade.

China, which had put in 97 billion its 2014-2024 plan to bridge its delays and reach the current 15% market share from scratch, is conceiving new measures in order to close the recent gap accumulated due to the political tensions with the U.S. and as a consequence of the pandemic. The Chinese ambition is to preserve its position: with this ambition in mind, China has been seeking ways to improve its self-sufficiency in chips with most latest being microprocessors. Since earlier this year, in a bid to minimize potential damage from US sanctions and to save on licensing fees, a growing number of Chinese chip design firms have adopted open-source RISC-V set architecture in their chip designs as an alternative to Intel’s proprietary X86 and Arm’s architecture. It seems that China will continue to capitalise on this application, in order to gain independence from those conceived within the U.S. companies and secure its share of the market.

In this framework, all the companies acting in the microprocessors sector are going to face the important challenge to develop a complete and integrated supply chain. An objective that will be achieved only if specific funds are allocated for this purpose and if public-private partnerships are put in place. If the U.S. and China are already implementing such approach, the European Union, certainly on the right path, will have to adopt the new rules for public financing to be up to the task and develop its own competitive advantage.

On their side, companies will have to consider several steps to continue their growth and meet customer demand. They could undertake more M&A deals and partnerships to ensure an advantage in profitable segments and expand their customer base. A raise in investments in innovative technologies will help them develop leading-edge chips for all kinds of IT products, from autonomous cars to the internet of things, to artificial intelligence, and to all other functions in permanent growth.

INCONCRETO services

The Construction is the biggest industry in the world, and yet, even outside of crises, it is not performing well: inefficiencies, overruns, delays and quality issues are common for that industry which represents 13 percent of global GDP.

INCONCRETO is a unique team of Senior Partners which improves predictable outcomes and steer profitability on Capex/Opex project investments. We quantify, assess, and share our expertise to drive your organization to the right decisions. We provide a unique platform combining digitization, ratings, and consultancy.

Our services offer is established on the latest consultancy market trends:

1) Digitization

2) Market focus

3) Global multi-sourcing

4) Digitalization

5) Agile (fail fast)

We remain open to new ideas, part of the global consultancy world and referenced as the capital projects expert.

For further reading, you may consult these sources:

- ‘Microprocessor Market Size is expected to reach at USD 163.8 Billion by 2030, registering a CAGR of 4.5%, Owing to Rising Utilization of IOT Technologies Globally’, by Globenewswire

- ‘What is a Microprocessor?’, by JavaPoint

- ‘What is a mircoprocessors and what are its applications’, by YoungWonks

- ‘Semiconductor’, in Britannica.com

- ‘Evolution of microprocessors’, by Geeksforgeeks

- ‘How Society and Technology Become Partners in Changing Our Lives’, by Brainspire

- ‘When the chips are down: How the semiconductor industry is dealing with a worldwide shortage’, by the World Economic Forum

- ‘Coping with the auto-semiconductor shortage: Strategies for success’, by McKinsey & Co.

- ‘How the Semiconductor Supply Chain is Affected by the Global Chip Shortage’, by Zhenhub

- ‘The global computer chip shortage explained: What it means for you and your tech’, by Android Authority

- ‘Industry Spec Paves Way for Processors Built on Chiplets From Multiple Vendors’, by PCMag

- ‘Les chiplets promettent de revigorer la loi de-Moore’, by Vipress.net

- ‘Can Chiplet’s technology work for Moore’s Law to “continue life”?’, by Shunlongwei Co. Ltd

- ‘UCIe™ (Universal Chiplet Interconnect Express™) Consortium Announces Incorporation and New Board Members; Open for Membership’ by Design&Reuse

- ‘A History and Analysis of Offshoring and Reshoring the US Semiconductor Industry’, by 3DInCities

- ‘FACT SHEET: CHIPS and Science Act Will Lower Costs, Create Jobs, Strengthen Supply Chains, and Counter China’, by the White House

- ‘Will the CHIPS Act really bring back semiconductor production and tech jobs?’, by ComputerWorld

- ‘The EU chips act: Securing Europe’s supply of semiconductors’, by the European Parliament

- ‘Fishing for Chips – Assessing the EU Chips Act’, by the Institut Français des relations internationals (IFRI)

- ‘Reshoring – Come l’Unione europea punta a diventare leader nel mercato dei microprocessori’, by Linkiesta

- ‘Exclusive: Italy, Intel close to $5 billion deal for chip factory’, by Reuters

- ‘As China cracks Western monopoly on CPU chips, US is trying to restrict SMIC’s advancement’, by TechWireAsia

Newsletter

© INCONCRETO. All rights reserved. Powered by AYM